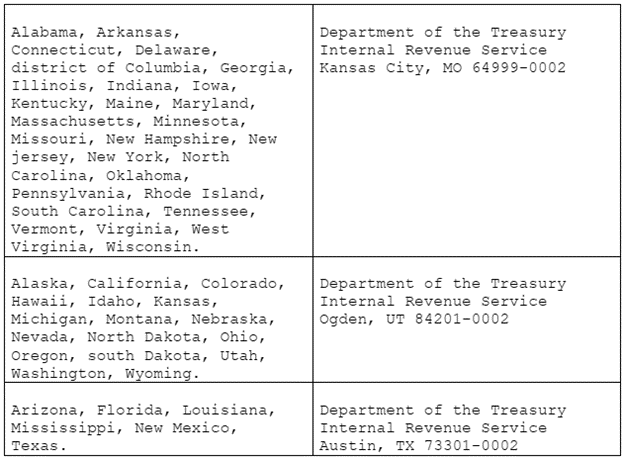

For tax returns expecting a refund, mail return to the address assigned to your state:

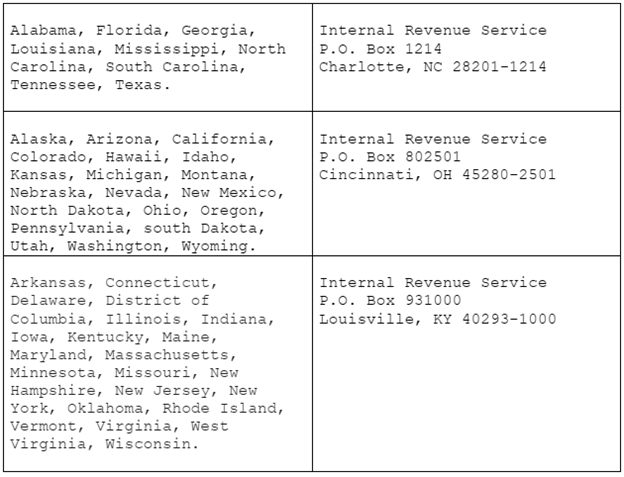

For tax returns enclosing a check or money order, mail to the address assigned to your state:

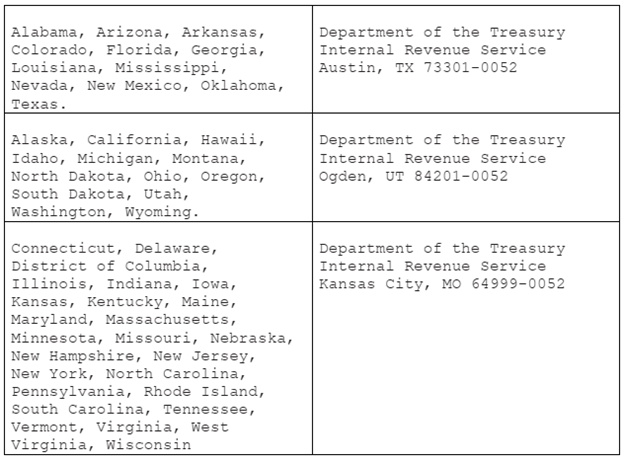

Amendments should be mailed to the address assigned to your state:

Note: When mailing a paper return or amendment, double-check you’ve signed. If you had a professional prepare the return, their signature must be on the return, as well. The IRS only accepts wet signatures on mailed returns.