1. You’re allowed to claim the saver’s credit and take the IRA deduction on your tax return.

The Retirement Saver’s Credit is a credit available to those who’ve made contributions to their traditional or Roth IRA, as well as to employer-sponsored retirement plans. The credit is an offset on your income tax.

An IRA deduction is an adjustment to your income. It lowers your taxable income, resulting in a lesser tax.

2. You need to meet 3 requirements to claim the saver’s credit.

1. Be older than 18.

2. Can’t be claimed as a dependent by anyone.

3. Can’t be a student.

3. You can’t claim the credit if your contribution was the result of a rollover from one plan to another.

4. The credit will only apply to a maximum contribution amount of $2,000 ($4,000 for married filing jointly).

For example, if you’re single and contribute $3,500 to your retirement plan, only $2,000 will count towards the credit.

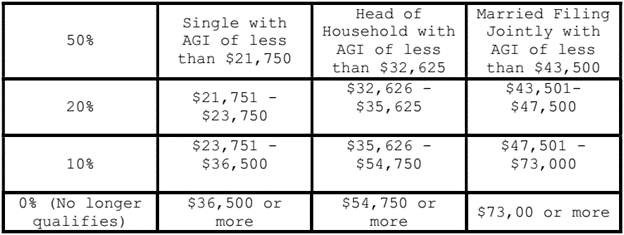

5. The amount of the credit has AGI limits.

Depending on your adjusted gross income (line 11 on Form 1040), your credit will be capped at 50%, 20%, or 10% of your contribution amount.

The following table shows the limits for 2023.

Using the previous example, if you’re single and made a $3,500 contribution only $2,000 qualifies for the credit. And if your AGI was $19,000 you’re due a credit of $1,000 (50% of contribution amount).

For more information visit the IRS’s retirement page.