One of the biggest misconceptions of individuals who register their businesses as LLCs with the state is that they’ll now be able to “pay themselves” from their business earnings.

It’s necessary to clarify how LLCs actually work, so that individuals can make the right decisions for themselves and their businesses.

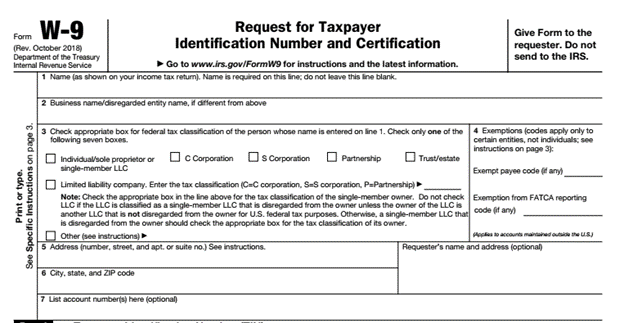

An LLC is a legal entity bound by the laws of the state it was registered in. An LLC is not by default a corporation for tax purposes. If you are the sole owner and member of your LLC you’re considered a disregarded entity by the IRS. This means that for income tax purposes you’re still considered a sole proprietor, and will still have to file a Schedule C. The only time you’re considered a corporation is when you hire employees, in which case you’ll need to apply for an EIN in order to file employer tax returns such as Form 941.

You are not obligated to remain a disregarded entity, however. The IRS offers business owners the option to become either a C corporation or an S corporation (each with their own specific tax rules and consequences).

In short, an LLC does not offer by default favorable tax treatment to sole proprietors, unless they change their classification to a C corporation or S corporation. LLCs do offer business owners some legal protection to their assets and might still be a good business option. It’s important to discuss this topic with both a lawyer and a tax professional if you’re thinking of going this route.

For more information check out IRS Publication 3402, Taxation of Limited Liability Companies.