There are three ways in which claiming a parent can benefit your tax return, provided you meet a few requirements.

Regardless of your filing status you can claim a parent as a dependent as long as that parent is not filing a joint return with someone else. The only exception is if that parent is only filing a return to receive a refund from taxes withheld. That parent must be a U.S. Citizen, U.S. National, U.S. Resident or a resident of either Canada or Mexico (with either a Social Security Number or ITIN).

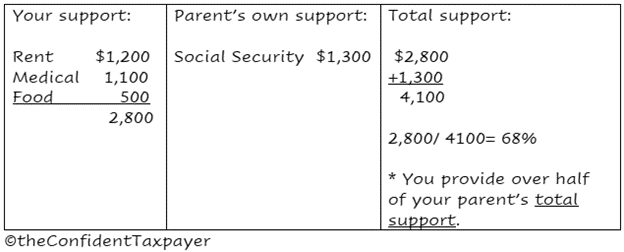

Your mom or dad must have under $4,400 in taxable income for the year. If their only income comes from Social Security none of that income is taxable. More than half of your parent’s total support must come from you. The following example shows how to calculate for such support.

If you’re unmarried or considered unmarried and provided over half of your parent’s support, then you qualify as Head of Household. Filing as Head of Household earns you a higher standard deduction, which helps lower taxable income. Your parent does not have to live with you to qualify you for Head of Household.

Aside from being able to claim your parent as a dependent, and qualifying as Head of Household, you might be able to claim the Credit for Other Dependents for a maximum of $500 per parent. This credit is nonrefundable. It will only lower your tax by the amount of the credit. For example, if your tax on line 16 of your 1040 is $900 and you’re only claiming one parent and qualify for the full $500 credit, your tax will come down to $400.

The Credit for Other Dependents is reduced for those filing a joint return if their AGI is over $400,000; and for all other filers whose AGI is over $200,000. In order to qualify for the credit your parent must be a U.S. Citizen, U.S. Resident, or U.S. National- only.