If your only income comes from social security benefits, generally there’s nothing to report and your benefits are not taxable.

If, however, you have additional income such as wages, pensions, capital gains, dividends, and interest, you will have to figure out how much is taxable, if any.

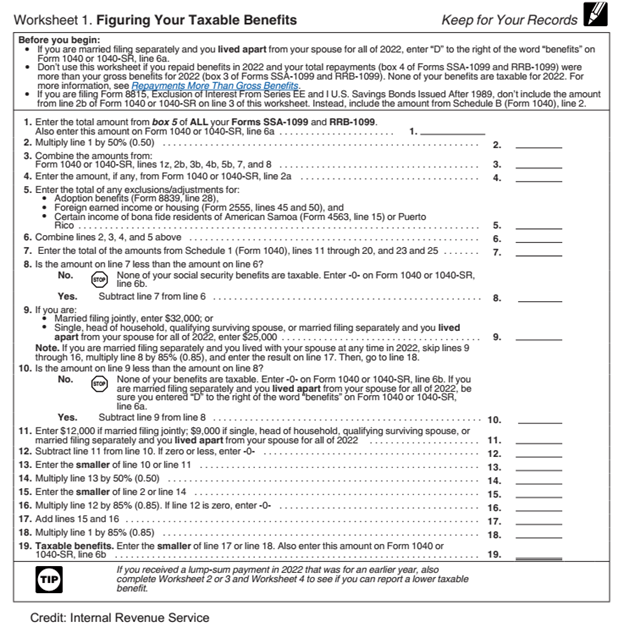

To figure out if any of your benefits are taxable you take 1/2 of your benefits and add it to your additional income. If you’re married and file jointly, you’ll have to combine both incomes. If you’re married and file jointly and your spouse isn’t receiving benefits yet, you’ll still have to combine incomes. If your income is more than your “base amount”, some of your benefits might be taxable.

Base amounts are based on filing status. For 2022 the base amounts were:

Single, head of household, and qualifying surviving spouse have a base amount of $25,000.

Married filing jointly has a base amount of $32,000.

Married filing separately (and lived apart from your spouse) has a base amount of $25,000.

Married filing separately (and lived with spouse) has a base amount of $0.

It’s important to note that even if your benefits are not taxable because you did not go over your base amount, you might still need to file a tax return to report your additional income. To find out how much of your benefits are taxable, if any, you’ll have to fill out Worksheet 1, found in the most current Publication 915 of the IRS.

If part of your benefits is taxable, and you anticipate this to be the case for future years, it’s important to prepare for a tax increase. One way to handle a higher tax is to have tax withheld from your benefits. You’ll need to submit Form W-4V with the Social Security Administration. Another option is to increase withholding on your other sources of income.