Deductions lower your taxable income. The lower your taxable income the lower your tax. The IRS gives you two options to lower your tax. The standard deduction or itemized deductions.

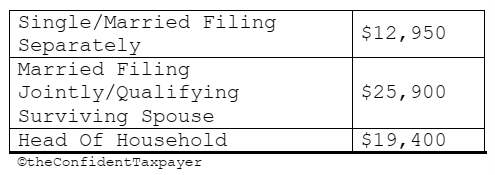

By default, each filing status is given a set amount to deduct. For 2023 those amounts were:

The standard deduction increases each year to adjust for inflation. There is no need to save receipts if you’re using this option.

The second option is to itemize deductions. This option might be beneficial for taxpayer who have qualifying deductions that add up to an amount higher than the standard deduction. In this case, saving receipts is a must.

Qualifying itemized deductions fall under the following categories:

Medical/dental expenses

State and local income taxes

State and local property taxes

Mortgage interest

Charitable contributions

(Visit the IRS for an extensive list of itemized deductions.)

Saving receipts might not be necessary if you think the standard deduction is as much as you’ll qualify for. In many cases, the standard deduction might be higher than all your qualifying itemized deductions tallied up. But even if you don’t need to save receipts, consider keeping track of your expenses for budgeting purposes.