If you’re planning on doing freelance work for a business, either a company or another independent contractor, they might have you fill out Form W9. This is typically the case if they’re expecting to pay you over $600.

The reason they have you fill this form out is because they’ll need your name and TIN (ssn or itin) for them to report your earnings to the IRS. This way, they can deduct what they paid you and have written evidence of that deduction. They send Form 1099-NEC (formerly 1099-MISC), to you and the IRS.

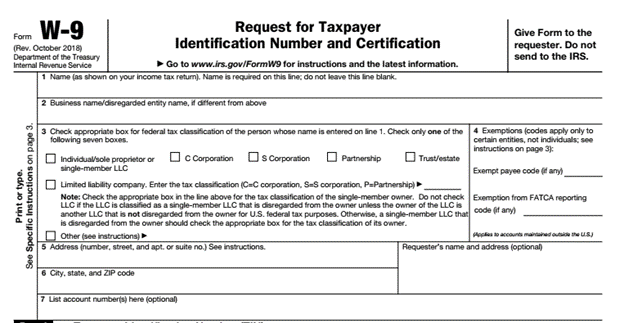

Filling out the form is very straightforward.

Line 1: Your name as it’s registered at the Social Security Administration.

Line 2: If you’ve registered your business under a fictitious business name, that name will go here. If you don’t have a FBN leave it blank.

Line 3: If you’ve never incorporated your business and have not applied for a corporate tax classification, check “Individual/sole proprietor”.

Line 4: Leave this section blank if you’re a sole proprietor (same as independent contractor) since you don’t qualify for any exemption to backup withholding (more on this later).

Line 5-6: Your address. This can be your home address if you operate from home, or your business address if you have an office.

Line 7: You can leave this blank.

Part I: If you have either a social security number or ITIN, write that down here. If you operate under an Employer Identification Number, you can write that instead.

Part II: Read certification, then sign and date if you comply.

Will they take taxes out of your checks?

They shouldn’t. Unlike a W2 job, the business giving you work is not responsible for submitting your taxes to the IRS. You’re solely responsible for paying your own tax.

Check out this post for more information on making estimated tax payments.

There is the matter of “backup withholding”, but this doesn’t apply to independent contractors unless they failed to provide their correct name or TIN.