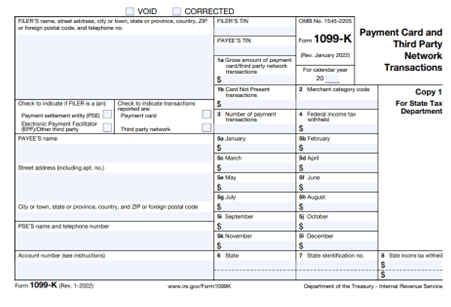

If you’ve started your first business or side hustle, you should know the two payment transactions that will produce a 1099-K.

There are two ways of getting paid when you’re doing business online.

1. Card payments.

This is done through payment service companies. Square is one example of these companies. It is also a more direct way of getting paid by a customer.

2. Third-party networks.

Platforms, like eBay and Fiverr, that allow you to sell through them are third-party networks. Although you may interact directly with a customer, when you get paid it goes through the platform first.

Reporting requirements:

Payment service companies have no minimum reporting thresholds. This means that if you get paid $5 through them it’ll get reported and you’ll get a 1099-K form.

Third-party networks have a minimum reporting threshold of $600. They will produce a report once you earn more than that amount.

What to do with a 1099-K:

Amounts shown on this form are reported on line 1 of Schedule C.

If you run more than one business or side hustle in different industries, you’ll have to report 1099-K amounts on each respective Schedule C.

For example: if you sell video editing services on Fiverr, you have to file a Schedule C for that service. If you also do Uber on the side, that will require another Schedule C. So, the 1099-K form you receive from Fiverr will go on the Schedule C for that service; the 1099-K from Uber will go on your ridesharing Schedule C.

Fees:

Any fees charged to you by the company issuing you the 1099-K are not included in the form. To deduct those, you will have to report those on line 10 of Schedule C. Form 1099-K is a straightforward form. It reports the monthly amounts of either card payments or selling revenue you’ve received in the course of your business or side hustle for the year. Amounts reported go on the Schedule C, where you can also include any qualifying deduction you incurred while earning that money.