Series EE and Series I bonds are a considerably safe way to start investing. When you purchase a U.S. Savings Bond, you’re lending money to the U.S. government and the government becomes obligated to pay you back plus interest.

The IRS allows taxpayers two ways to report the interest. You can either report all the interest at once the year you cash in your bond, or you can report the interest every year. If you purchase both Series EE and Series I bonds, the method you use to report interest for one will apply to both types of bonds. You’re allowed to start paying interest every year if you had initially opted for paying all at once the year your bond is cashed. You’ll need permission from the IRS, however, if you wish to switch from paying interest every year to paying it all at once.

Typically, the person who purchases the bond is the person who must report and pay tax on interest earned. This is so even if the bond is registered to co-owners. If both co-owners purchased the bond, then interest is taxable to both owners. In cases when a bond is purchased for a child and is registered only in the name of the child, then interest is taxable to the child.

For those who choose to report interest the year of redemption, you’ll receive Form 1099-INT if interest is more than $10. Those who choose to report interest each year will also receive Form 1099-INT, however, an adjustment might have to be made on the return if paper bonds were purchased. This is because the Treasury method for processing paper bonds is not as efficient as it is for electronic bonds.

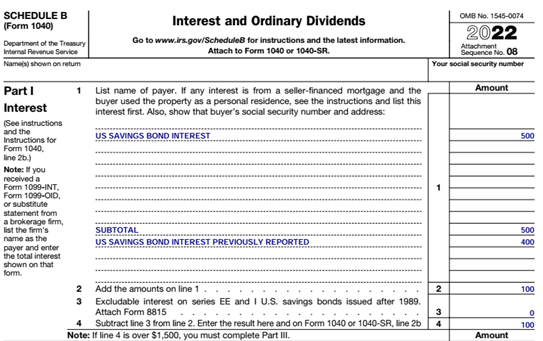

Adjustments are made on Schedule B. The following example shows how to make such an adjustment.

For more information on Series EE and Series I bonds, visit the Treasury Direct site.