The US tax system is a pay-as-you-go system. Meaning that you must pay taxes as you earn income.

There are two ways of paying taxes. You can pay either through withholdings or by making estimated payments.

Individuals employed by others fill out Form W-4 to indicate how much should be withheld from their paychecks. Freelance individuals, however, are solely responsible for making those tax payments. They do this through estimated tax payments.

Should you be making estimated payments?

If you have decided to earn extra income on the side through one of the many gigs available, you might have to.

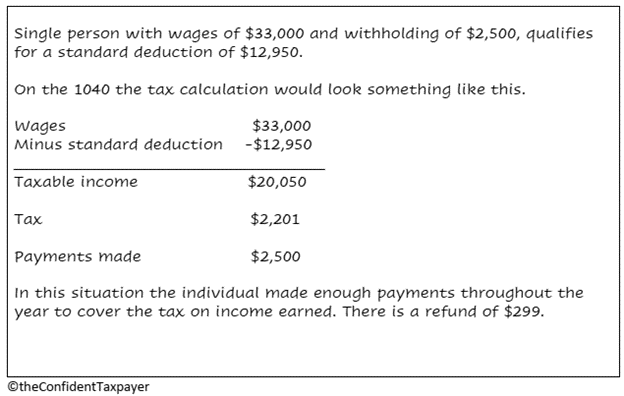

The following is a hypothetical tax scenario for a single person with one W2. The numbers used for wages and withholding are made up to simplify the tax calculation.

In this example the individual had enough withheld and will receive a refund. In a different example, however, this individual earned extra income through ridesharing.

In this second scenario estimated payments would have prevented a tax liability at tax filing time.

So how do you make estimated payments?

The first step is to estimate how much you will earn in the year. This will help you estimate the tax you will owe. Once you have this information you can break the estimated tax into four payments. Each payment has its due date.

Typically, the first payment is due April; second payment is due in June; third payment is due September; the fourth payment is due in January and can be paid along with the tax return.

Form 1040-ES provides worksheets to help calculate estimated taxes. The form also provides payment options accepted by the IRS.