Alimony or separate maintenance payments are only deductible if executed under a divorce or separation instrument before 2019. Payments executed after 2018 are not deductible by the payer, nor are they taxable to the recipient. It’s possible for divorce or separation instruments executed before 2019 to be later modified to state that alimony is no longer deductible by the payer or taxable to the recipient.

For those allowed to deduct alimony payments, they can do so on Schedule 1, line 19a.

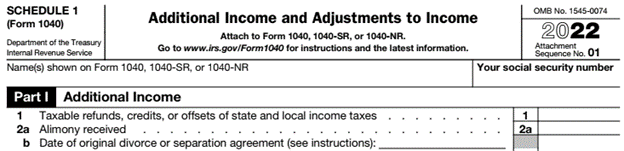

For those having to report alimony payments received, they do so on Schedule 1, line 2a.

Both payer and recipient must include the social security numbers of their spouse or former spouse. If a taxpayer pays alimony to multiple individuals, the social security numbers of all individuals must be included. The same goes for a recipient receiving alimony from more than one individual.