Starting a new job means filling out a new Form W4. It’s easy to forget about that form if you stay at the same job longer than a year. It’s important to know that you can always go back and update your W4 whenever a change happens.

A change, for example, is signing up for a side gig that will report your earnings on a 1099. A side gig such as Uber or Doordash. In a situation like this, you’ll be solely responsible for paying your taxes directly to the IRS. This is a burden freelance workers must deal with.

Freelance workers are responsible for making quarterly payments to the IRS to cover their income tax and self-employment tax.

Another way to pay that tax is to increase your withholding at your current job. A common reaction to this advice is, “But they already take so much!” True, but the reality is, if your income is expected to increase so will your tax. You’ll owe that tax, whether you pay it now or later. The best course of action is to take control now.

One way to take control is to fill out a new Form W4, so that payroll can withhold enough to cover your side gig. You’ll need to include the expected freelance income and self-employment tax on the form.

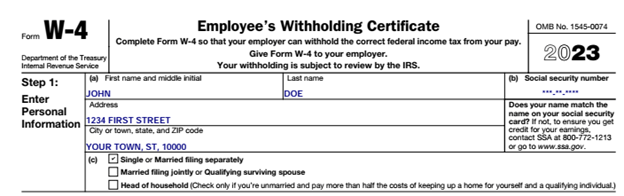

The following example shows how a single person with no dependents might fill out a new W4.

Step 1 is complete, and the single box has been checked off.

We’re going to skip steps 2 and 3, and complete Step 4.

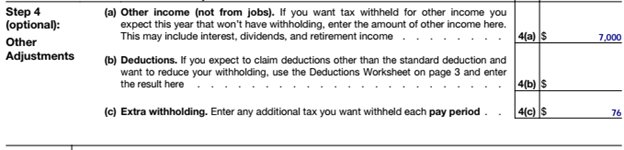

This individual estimates that he will make $7,000 through his side gig, so he includes that amount on line 4(a). Payroll will add this amount to his earnings when calculating withholdings.

He ignores line 4(b) and completes line 4(c). The $7,000 side gig will be subject to the Self-Employment Tax. Extra withholding is meant to take care of that.

In this example, 7,000 is multiplied by 14.13% (SE Tax). The SE Tax on those $7,000 is roughly $989. Let’s assume John is halfway through the year and only has 13 more pay periods left. We divide 989 by 13 and get 76.

John is going to have an extra $76 withheld from his paychecks.

Although basic, this example is meant to take away the mystery out of Form W4 and give you more control over your tax planning.