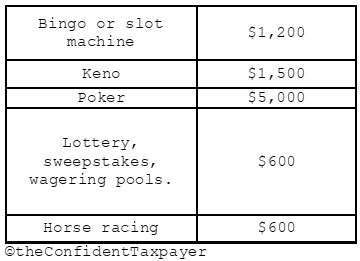

Gambling winnings are reported on Form W-2G. Depending on the game, you’ll get it once you pass the winning threshold.

The chart below shows the minimum you must win to trigger a W-2G form from the following games.

It’s possible this additional income will lower your refund or increase a tax liability. This leads to the question: Can I deduct any gambling losses?

Taxpayers are allowed to deduct gambling losses up to their winnings. Meaning that if someone has winnings of $5,000, they can deduct losses up to $5,000 only.

Not everyone is able to claim losses, however. Losses are reported on Schedule A, the form used to claim itemized deductions.

Itemized deductions include mortgage interest, medical expenses, charitable contributions, certain personal taxes.

By default, most tax preparation software will give you the highest of either standard deduction or itemized deduction. So, if your itemized deductions are not more than your standard deduction the software will give you the standard deduction.

If you have enough itemized deductions to file Schedule A and decide to deduct your gambling losses, you have to keep accurate records of both winnings and losses.

The IRS suggests keeping a diary of winnings and losses. As well as keeping copies of records issued by the gambling establishments.

The diary should contain the following information:

- The date and name of wager played.

- The name and address of the gambling establishment.

- Amounts won and lost.

- Names of persons with you at the time of your wager.

The following IRS publications offer more information on the topics discussed above.